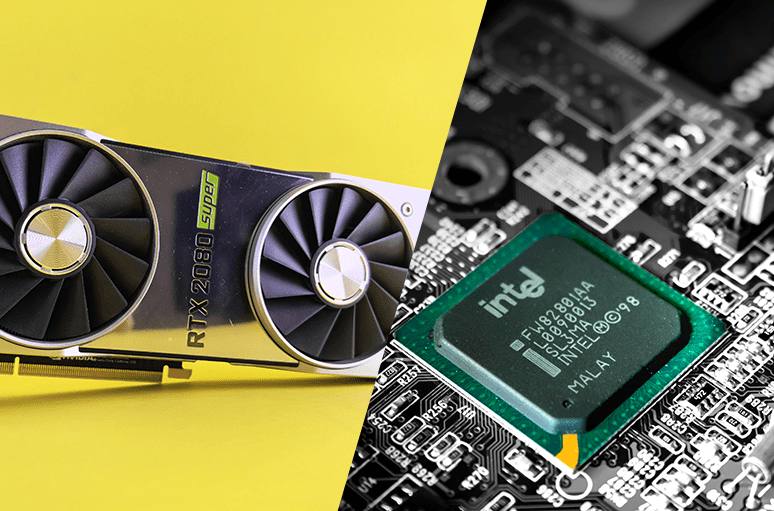

Nvidia, the world’s leading AI chipmaker, is investing $5 billion in rival Intel, with the two U.S. companies working together to produce chips for computers and AI data centers, according to yesterday’s announcement of the commercial agreement.

The investment is being treated as a financial “lifeline,” as Intel, the company behind the PC boom a few decades ago, is now facing financial difficulties. This is due to its inability to benefit from the rise of AI in the way Nvidia has, with Intel’s market value standing at $100 billion, while Nvidia’s has skyrocketed to $4 trillion.

State intervention in Intel was carried out with the aim of “strengthening the U.S. leadership in chip production,” according to Reuters.

The agreement also makes Nvidia one of Intel’s largest shareholders, with roughly a 4% stake in the company. One of the main reasons Nvidia is investing in Intel is to diversify part of its production away from other competitors, mainly Taiwan’s TSMC, according to an expert who spoke to the BBC, while the move is also intended to support the U.S. government in its effort to strengthen the only American company capable of producing chips domestically.

A few weeks earlier, the U.S. government announced it would invest $8.9 billion in Intel, acquiring nearly 10% of the company. State intervention in Intel was carried out with the aim of “strengthening the U.S. leadership in chip production,” according to Reuters.

What is fyi.news?

What is fyi.news?